Ira withdrawal calculator

Starting the year you turn age 70-12. Currently you can save 6000 a yearor 7000 if youre 50 or older.

How Does An Ira Loan Work Smartasset Com

The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required.

. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. If its not you will. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Use this calculator to determine your Required Minimum Distribution RMD. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. All payment figures balances and interest figures are estimates based on the.

Money deposited in a traditional IRA is treated differently from money in a Roth. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. If you are under 59 12 you may also.

You should consider the retirement withdrawal calculator as a model for financial approximation. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. 0 Your life expectancy factor is taken from the IRS.

You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life.

Use our IRA calculators to get the IRA numbers you need. 25Years until you retire age 40 to age 65. Direct contributions can be withdrawn tax-free and penalty-free anytime.

You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. This is a very. Revised life expectancy tables for 2022 PDF Important calculator assumptions See your.

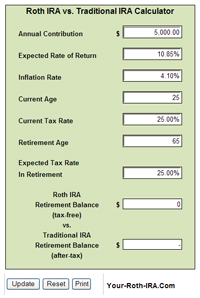

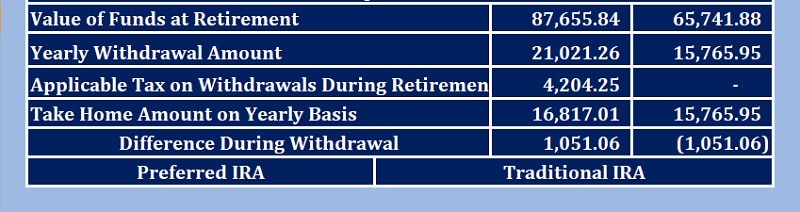

Since you took the withdrawal before you reached age 59 12 unless you met. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. Calculate the required minimum distribution from an inherited IRA.

Roth IRA Distribution Details. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution -. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on.

Unfortunately there are limits to how much you can save in an IRA. Not an easy task. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

Decide how to receive your RMD. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for.

7000000 Life expectancy factor. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe.

Best Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Calculate Rmds Forbes Advisor

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Retirement Withdrawal Calculator Excel Formula Youtube

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Roth Ira Calculator Excel Template For Free

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Download Traditional Ira Calculator Excel Template Exceldatapro

7 Ways To Find The Best Ira Calculator For Ira Distributions Withdrawal And Retirement Calculations Advisoryhq

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113