Payback period formula

The payback period formula is easy to calculate. For example if a company invests 300000 in a new production line and the production line then produces.

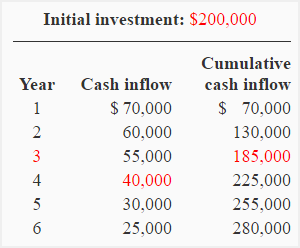

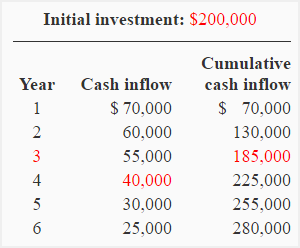

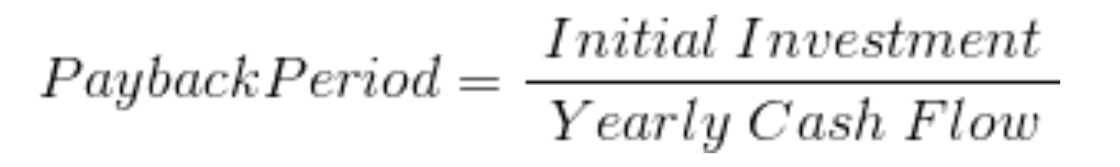

Undiscounted Payback Period Discounted Payback Period

Payback Period 3000000.

. Where I is an initial investment the amount of money that has been invested at the beginning and CF is cash flow. Cash flow per year. - ln 1 -.

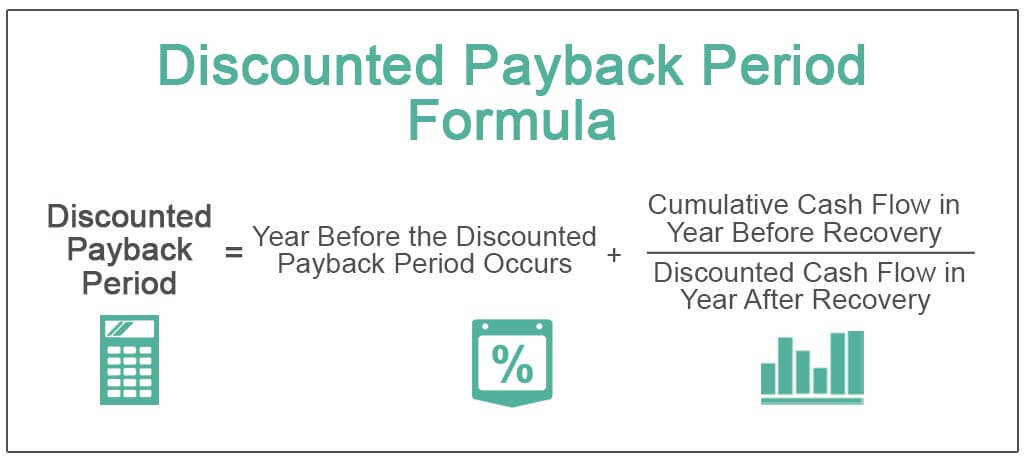

Payback Period Example. Paybackperiod frac I CF P ayback period CF I. As mentioned before it is the most straightforward way to calculate the time taken to reach the.

The payback period for this investment is 7 and a half years - which we calculate by dividing 3 million with 400000 using the formula shown below. The formula for discounted payback period is. Written out as a formula the payback period calculation could also look like this.

Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years. Say Kapoor Enterprises is considering. The payback period formula is pretty simple assuming the income generated from the project is constant.

Payback Period Initial Investment Annual Payback. Discounted Payback Period. Find Cash Flow in Next Year.

For example imagine a. Lets understand the Payback Period Formula and its application with the help of the following example. Ln 1 discount rate The following is an example.

Calculate Net Cash Flow. Retrieve Last Negative Cash Flow. The result of the payback period.

Any time a business purchases an expensive asset its an. Investment amount discount rate. Advantages and Disadvantages of Payback Period formula.

By substituting the numbers into the formula you divide the cost of the investment 28120 by the annual net cash flow 7600 to determine the expected payback period of. Input Data in Excel. What is the payback period.

The payback period formula is used for quick calculations and is generally not considered an end-all for evaluating whether to invest in a particular situation. Use the PMP exam formula below to calculate the payback period of a project. The payback period is expressed in years and fractions of years.

When applying the payback period formula to a specific investment you can take the initial cost of the investment and divide it by the investments yearly cash flow.

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Method Commercestudyguide

Undiscounted Payback Period Discounted Payback Period

Discounted Payback Period Meaning Formula How To Calculate

Payback Period Summary And Forum 12manage

Capital Investment Models Payback Period Youtube

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator

How To Use The Payback Period

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

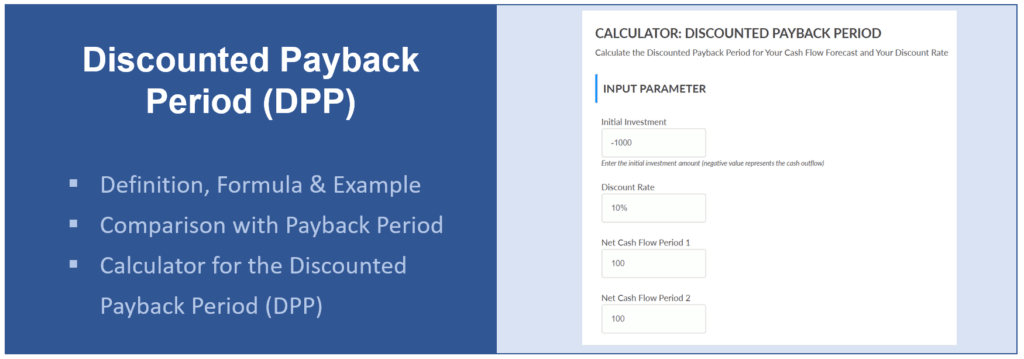

Discounted Payback Period Definition Formula Example Calculator Project Management Info

How To Calculate The Payback Period With Excel

What Is Payback Period Formula Calculation Example

Payback Period Formula And Calculator

How To Calculate The Payback Period With Excel

Payback Period Method Double Entry Bookkeeping

Cac Payback Period Months To Recover Cac Formula